全文HTML

-

家族企业是广泛存在的一种企业组织形式,在全世界企业中占比约65%~80%,对全球经济发展具有至关重要的作用[1]。Diéguez-Soto和López-Delgado等许多学者研究家族化管理如何影响家族企业财务绩效这一问题[2]。其中,家族成员任职总经理[3]、代际传承[4]、关联董事占比[5]、兄弟姐妹共同经营[6]等家族管理的不同方面对家族企业财务绩效的影响都受到学者们的关注。然而,作为企业生存并获得可持续发展的关键因素,学者们关于家族管理对家族企业财务绩效的影响并未达成共识[7]。

从不同的理论出发,学者们对家族化管理与家族企业财务绩效之间关系进行了大量的研究。其中,根据高阶理论,Ahrens等学者认为家族成员以高层管理团队成员的身份参与企业日常经营管理,家族成员的经营决策和日常管理等行为必然会对家族企业财务绩效产生影响[8]; 根据委托代理理论,Hoffmann等学者认为家族成员既是企业所有者,同时也以经营者身份参与企业管理,一定程度上提高了所有者与经营者的利益一致性,能够有效缓解委托代理冲突,对家族企业财务绩效具有积极的影响[9]; 根据社会情感财富理论,Ng等学者认为家族成员综合考虑家族经济目标和非经济目标,参与企业管理并进行经营决策,对家族企业财务绩效产生显著影响[10]。

随着相关研究进一步深入,学者们开始更多地探究企业规模[11]、所有者年龄[12]、股权结构[13]、研发强度[14]等因素会对家族化管理与家族企业财务绩效间关系产生何种的影响。然而,现有文献很少从外部环境角度出发,探究其对家族化管理与家族企业财务绩效之间关系影响,仅有少数研究表明企业与外界的政治关联[15]、制度和环境不确定性[16]对家族化管理与家族企业财务绩效之间关系产生影响。从本地嵌入视角出发,家族企业更倾向于本地市场,家族企业所处地域的文化、社群和产业等因素都会对家族企业具有重要影响,在地域内树立良好形象,并借此构建信任和合作关系有利于家族企业可持续成长[17]。此外,由于我国领土广阔,地域文化差异巨大,且地域文化对人们的目标、行为和决策方式都具有重要影响[18]。因此,探索家族化管理对家族企业财务绩效的影响,并将企业所处市场环境因素纳入研究框架,综合分析家族企业内部管理因素和外部环境因素对家族企业财务绩效的影响,有利于保持家族企业基业长青,促进宏观经济发展。

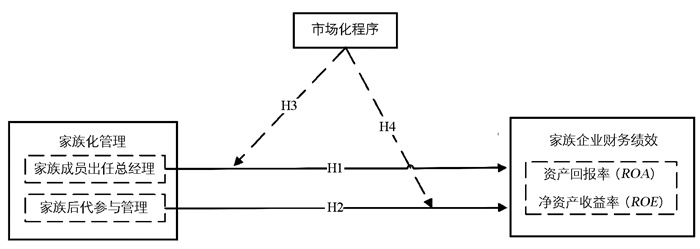

根据上述分析,本研究以2008-2020年在主板和中小企业板上市的家族企业为研究对象,研究家族成员出任总经理以及家族后代成员参与管理对家族企业财务绩效的不同影响。同时,结合外部环境影响,分析在地区市场化程度不同的情况下,家族化管理对家族企业财务绩效的影响。本文的主要贡献在于:证实了家族成员出任总经理与对家族企业财务绩效的积极影响,并揭示其影响机理; 证实了家族二代成员参与管理对家族企业财务绩效的消极影响,并揭示其影响机理,为相关研究提供了实证证据; 将市场化程度作为调节变量纳入家族化管理对家族企业财务绩效的研究框架之中,从权变理论出发,揭示了外部市场环境的重要性,为从不确定情景角度拓展和丰富相关研究提供思路。

-

现有关于家族化管理对家族企业财务绩效影响的相关研究主要是从家族成员出任总经理或家族代际传承两个角度出发的。Corbetta和Montemerlo研究认为家族化管理指家族成员参与家族企业的日常经营管理、重大决策和企业长期发展战略的制定[19]。总经理占据企业管理层的核心地位,在日常经营管理中也相应地享有最大决策权。因此,以家族成员出任总经理与否衡量家族化管理程度[20]。此外,随着家族企业成立年限的增长,家族化管理必然涉及代际传承、经营权过渡等家族二代甚至三代成员参与管理的问题,家族后代参与管理对家族企业财务绩效的影响也逐渐受到学者们的关注。根据上述分析,从家族成员出任总经理和家族后代参与管理两个角度出发,探究上述两项因素分别对家族企业财务绩效产生的影响。

连燕玲等学者认为家族成员出任总经理可能使得公司内部存在严重的裙带关系和利他主义,违背了精英管理原则,使得委托代理成本增加,损害家族企业财务绩效[21]。Ahrens等学者的研究发现家族成员出任总经理对家族企业财务绩效的提升具有显著促进作用[22]。究其根源,Habbershon等学者认为家族成员出任企业总经理有利于降低委托人和代理人之间的利益冲突,实现对家族企业财务绩效的提升作用[23]; Maury等学者认为家族成员拥有独特的资源和能力参与家族企业管理[24]。Gallucci等学者认为家族成员通过出任总经理等方式参与家族企业管理,可以实现家族对企业的积极控制,会极大程度上提高家族企业的经营绩效[25]; Mcconaughy等学者提出当家族成员出任总经理时,可以被看作是家族企业的“管家”,家族企业的良好绩效和基业长青都是其获得个人报酬的有力保障,会更加努力工作提升家族企业财务绩效[26]。

相比于发达资本主义国家而言,国内家族企业发展起步晚,超过百年的家族企业数量十分有限,多数家族企业仍处于创始人控制阶段。此外,数千年的中华历史文明使得中国人对于传统“家族文化”会产生本能的偏好[27]。对家族文化的追求强调家族的延续、并且以家族的认同感与强化为特征,强调以家族利益为重,甚至在关键时刻需要牺牲个人利益而确保家族整体利益。因此,保持家族企业的生存和发展,实现家族企业基业长青和代际传承是当前我国大多数家族企业的最主要目标。在此背景下,根据资源基础观理论,相比于职业经理人,家族成员更加倾向于主动发挥其管理才能,为企业引入其自身丰富的社会资源; 根据社会情感财富理论,当家族成员出任总经理时,企业具有更强的“家族性”特征,家族兴衰与企业的长期可持续发展密切相关,家族成员会努力提高经营运作效率,实现家族企业财务绩效的提升; 此外,相比于职业经理人,家族成员任职企业管理者任期往往更长,有利于保持家族企业经营管理战略的一致性和人员结构的稳定性,且加之长期在家族生活中的耳濡目染,对家族企业的认同感和归属感都会比职业经理人更高,对提升家族企业财务绩效具有正向影响。

因此,本文提出如下假设:

H1:家族成员出任总经理有助于提升家族企业财务绩效。

家族成员代际更替是涉及家族企业能否实现基业长青的重要因素,后代家族成员逐步深入参与家族企业管理正如一把“双刃剑”,在实现权力从创始人向继承者过渡的同时,可能为企业引入新思路和发展机遇,亦可能引起内部动荡,绩效下滑。Arzubiaga等学者研究认为代际更替对家族企业财务绩效具有显著的积极影响[28],Reisinger等学者认为后代参与管理能够扩展管理层人员的教育背景和专业知识多样性,扩大社会网络资源,引入新理念,提高企业创新发展的动力[29]。与之相反的是,Amran和Ahmad等学者的研究表明代际传承不利于提升企业财务绩效[30]。相比于后代家族成员而言,创始人能够清楚掌握企业发展现状、优势与劣势,对企业未来发展具有明确规划,且极具使命感和个人影响力,当后代家族成员参与企业管理时,为维持企业经营,其个人能力会面临诸多挑战,此外,后代家族成员不需要从零开始累计资本和市场份额,很可能导致其在未经合理规划的前提下过度消耗企业现金流,损害家族企业财务绩效。

中国有古语云“创业难,守业亦难”,代际传承的难度可见一斑。加之受到历史因素的影响,国内的百年家族企业数量非常有限。目前,国内家族企业大多刚刚开始面临代际传承问题,家族后代成员逐步开始参与企业管理。受中国传统文化影响,家族后代成员是否参与企业管理至接手企业经营权主要由亲疏关系决定,而非能力决定。根据高阶理论,企业高管的教育背景和经历、个人经验与能力都会对家族企业财务绩效产生影响。相比于创始人而言,家族后代成员往往缺乏行业经验和企业管理经验,会导致企业运作效率降低,决策失误的可能性更大,损害家族企业财务绩效。

因此,本文提出如下假设:

H2:家族后代成员参与管理会导致家族企业财务绩效降低。

-

所有组织都处于一定的环境中。现有研究从委托代理理论、社会情感财富理论和制度基础观等不同角度出发,研究结论均表明制度环境对家族管理与家族企业财务绩效之间关系具有一定影响。根据委托代理理论,外部环境对家族管理与家族企业财务绩效之间的关系具有一定影响。从社会情感财富理论出发,周立新研究结果表明制度环境对家族企业创业导向与家族企业成长二者之间关系具有显著的正向调节作用[31]; 根据制度基础观,黄丽英和何乐融研究发现地区市场化程度能够有效降低家族所有权对企业国际化程度的负向影响[32]; 杨婵等的研究表明在制度环境越不完善的地区,“创一代—至亲”的家族成员组合治理模式对家族企业经营绩效的提升作用越强[33]; 尤其在外部制度环境相对恶劣时,采用跨代治理是提高家族企业经营绩效的有效途径。

地区市场化程度是企业外部制度环境不确定性重要来源,是该地区法律法规制度完善程度和市场在资源配置过程中作用的体现[34]。从区域文化视角出发,当地区市场化程度越高,则体现该地区的绩效导向程度越高,表明该地区导向对个体绩效和企业绩效的重视,能够更好地避免过度重视亲缘关系对家族企业造成的负面影响。从家族嵌入视角出发,如所在区域产业发达且形成如浙商、闽商、粤商等具有互帮互助的社群文化,则深度嵌入该地区的家族企业更容易从其与周围的联系中获取信息等资源,提升家族企业财务绩效。目前,受不完善的法律制度、投融资制度、欠发达的公司治理发展阶段和有限的职业经理人市场的影响,国内家族企业的发展通常受制于所在地区的制度环境[35]。在市场化程度高的地区,按照市场原理和标准化制度,实现资源和要素的优化配置,职业经理人市场资源丰富且道德风险得到控制,家族成员出任总经理的优势无法得到充分发挥; 同时,为确保家族企业基业长青,企业主更加倾向于任人唯贤,而非任人唯亲,家族后代成员“搭便车”等机会主义行为受到抑制,其只有在不断提升自身实力和经营管理能力时,才可能顺利实现经营权的继承。反之,在市场化程度低的地区,家族关系等非正式制度常常发挥更大的作用,职业经理人市场资源不足,家族成员出任总经理所隐含的一系列资源优势得以充分发挥,同时,家族后代成员难以感受到来自职业经理人市场和父辈创业者两方面的压力,更容易导致家族后代成员不思进取或发生“搭便车”等机会主义行为。根据以上分析,本研究推断:在制度不完善地区,家族成员出任总经理对家族企业财务绩效的积极影响较大,家族后代成员参与管理对家族企业财务绩效的消极影响较大; 在制度相对完善地区,投资者保护制度也更加完善,家族成员出任总经理对家族企业财务绩效的积极影响较小,家族后代成员参与管理对家族企业财务绩效的消极影响会受到抑制。

因此,本文提出如下假设:

H3a:市场化负向调节家族成员担任总经理与家族企业财务绩效之间关系。

H3b:市场化正向调节家族后代成员参与管理与家族企业财务绩效之间关系。

一. 家族化管理与家族企业财务绩效

二. 制度环境的调节作用

-

本研究选择2008-2020年在A股主板上市且由家族直接创办的家族企业为样本,通过国泰安CSMAR数据库获得相关股权信息、财务信息以及注册地等信息。对家族企业相关数据进行筛选并将异常值剔除,最终得到有效样本3 008个。

-

资产回报率(ROA),体现总资产的盈利能力,且不易受盈余管理影响。

净资产收益率(ROE),体现净资产的盈利能力。

-

家族成员担任总经理(Fgm)。虚拟变量,企业总经理是否由家族成员担任,如是,则取值1,否则取值0。

家族后代成员参与管理(Gen)。虚拟变量,是否有家族后代成员参与管理,如是,则取值1,否则取值0。

-

市场化程度(MD),根据各省份市场化总指数评分衡量企业所在省份市场化程度[36],其中,2019年和2020年市场化程度指数是以2017年和2018年数据为基础推算得到。

-

根据相关研究成果,共设置以下6项控制变量,包括成立年限(Age),企业规模(Lnsize),海外销售收入占比(Fsts),资产负债率(Lev),行业(MI)和年份(Year)。主要变量定义见表 1。

一. 样本与数据

二. 变量设计

1. 被解释变量

2. 解释变量

3. 调节变量

4. 控制变量

-

根据表 2对样本数据的描述性统计结果可以看出,上市家族企业的资产回报率均值为0.073 1,净资产收益率均值为0.089 1,表明家族上市公司财务绩效较好,且二者的方差表明家族上市公司绩效之间具有较大差异。虚拟变量家族成员出任总经理的均值为0.542 4,标准差为0.498 2,表明超过半数家族企业以家族成员担任核心管理职务,虚拟变量家族后代成员参与管理的均值为0.178 3,标准差为0.382 4,表明家族企业仍以一代成员参与管理为主,后代成员参与企业管理的占比较低。

主要变量之间的Person相关系数见表 3。可以看出,家族成员出任总经理(Fgm)与资产回报率(ROA)的相关系数为0.033 1,且在5%水平上显著; 家族成员出任总经理(Fgm)与净资产收益率(ROE)的相关系数为0.041 6,且在1%水平上显著,家族成员出任总经理(Fgm)分别与资产回报率(ROA)、净资产收益率(ROE)的显著正相关关系初步表明家族成员出任总经理对家族企业财务绩效可能存在显著正影响; 家族后代参与管理(Gen)与资产回报率(ROA)的相关系数、家族后代参与管理(Gen)与净资产收益率(ROE)的相关系数初步表明家族后代参与管理对家族企业财务绩效存在显著负影响,且解释变量与控制变量之间不存在显著的多重共线性。

-

本研究采用逐步回归分析法。首先,对解释变量家族成员出任总经理(Fgm)、家族后代成员参与管理(Gen)与调节变量地区市场化程度(MD)进行中心化; 其次,分别将解释变量家族成员出任总经理(Fgm)、家族后代成员参与管理(Gen)纳入模型进行回归,结果见表 4和表 5中模型(1)和(2)所示; 再次,加入调节变量地区市场化程度(MD),结果见表 4和表 5中模型(3)和(4)所示; 最后,分别在上述模型中加入解释变量家族成员出任总经理(Fgm)与管理(Gen)与调节变量地区市场化程度(MD)、解释变量家族后代成员参与管理(Gen)与调节变量地区市场化程度(MD)的交乘项,结果见表 4和表 5中模型(5)和(6)所示。此外,如加入交乘项的模型拟合系数R2相比原R2的变化超过2%,则调节效应显著。

通过表 4中模型(1)和(2)可以看出,家族成员出任总经理(Fgm)对企业资产回报率(β=0.021 4,P<0.01)和净资产收益率(β=0.0592,P<0.1)均具有显著正向影响。由此证明家族成员出任总经理有助于提升家族企业财务绩效。主要原因包括如下方面:相比于职业经理人,家族成员出任总经理时,其个人利益与企业利益具有更高的一致性,故更倾向于主动引入更多社会资源,助力家族企业发展; 当家族成员出任总经理时,企业具有更强的“家族性”特征,家族兴衰与企业的长期可持续发展密切相关,家族成员会努力提高经营运作效率,实现家族企业财务绩效的提升和基业长青。

通过表 4中模型(5)和(6)可以看出,解释变量家族成员出任总经理(Fgm)与调节变量地区市场化程度(MD)的交乘项对企业资产回报率(β=-0.0110,P<0.05)和净资产收益率(β=-0.021 2,P<0.01)具有显著负向影响; 且模型(1)的R2值为0.125 7,模型(5)的R2值为0.146 2,变化大于2%;且模型(2)的R2值为0.192 9,模型(6)的R2值为0.223 7,变化大于2%。由此,假设H3a验证通过,即市场化负向调节家族成员担任总经理与家族企业财务绩效之间关系。当地区市场化程度越低,家族成员出任总经理对家族企业财务绩效的提升作用越显著; 反之,当地区市场化程度越高,家族成员出任总经理对家族企业财务绩效的提升作用越不显著。在市场化程度低的地区,信息透明度低,职业经理人资源有限,家族成员的所有权优势得以更好地发挥; 在市场化程度高的地区,现代化公司治理理念和方式得到更加广泛的应用,职业经理人市场资源更加丰富,家族成员出任总经理的优势得不到充分发挥,家族企业更适合现代化的职业经理人进行公司治理,有利于家族企业财务绩效的提升。

通过表 5中模型(1)和(2)可以看出,家族后代成员参与管理(Gen)对企业资产回报率(β=-0.017 9,P<0.05)和净资产收益率(β=-0.038 4,P<0.01)均具有显著负向影响。由此,假设H2验证通过。家族后代成员参与管理对家族企业财务绩效具有显著的负向影响,与学者们对欧美发达国家市场研究结果不同,近年来,国内家族企业初涉代际更替这一问题,对家族后代成员的学历教育、管理能力等方面的前期培养和锻炼多有不足之处,使得家族后代成员在参与企业管理时,未能充分发挥对家族企业财务绩效的积极影响,反而可能由于其个人能力、家族荣誉感、使命感和对企业认知的不足,导致其对家族企业财务绩效产生负面影响。

通过表 5中模型(5)和(6)可以看出,解释变量家族后代成员参与管理(Gen)与调节变量地区市场化程度(MD)的交乘项对企业资产回报率(β=0.014 2,P<0.1)和净资产收益率(β=0.012 6,P<0.05)具有显著正向影响; 且模型(1)的R2值为0.125 4,模型(5)的R2值为0.135 9,变化大于2%;且模型(2)的R2值为0.191 9,模型(6)的R2值为0.202 6,变化大于2%。由此,假设H3b验证通过,即市场化程度正向调节家族后代成员参与管理与家族企业财务绩效之间关系。当家族上市企业所在地区市场化程度越低,企业创始人更加倾向于家族后代参与,导致家族后代成员更容易“搭便车”,家族后代参与管理对家族企业财务绩效的抑制作用越显著,对家族企业财务绩效的负向影响更加显著; 反之,当家族上市企业所在地区市场化程度越高,家族后代参与管理对家族企业财务绩效的抑制作用越不显著。在市场化程度高的地区,家族后代成员更容易感受到竞争压力,为顺利参与并接管家族企业,会不断提高自身实力,且以家族利益为出发点进行经营决策,家族后代成员参与管理对家族企业财务绩效的负向影响受抑制。

-

首先,本研究通过替换被解释变量证明研究结果的稳健性,分别以资产回报率和净资产收益率两项指标分别衡量家族企业财务绩效,回归结果仅在数值上存在一定差异,所得结论依然成立,表明研究结论可靠。其次,对被解释变量一期滞后。在表 6中(1)和(2)可以看出,自变量家族成员出任总经理(Fgm(-1))对当期企业资产回报率(β=0.027 3,P<0.05)和净资产收益率(β=0.068 3,P<0.01)均具有显著正向影响; 在表 7中模型(1)和(2)可以看出,前一期家族后代成员参与管理(Gen(-1))对当期企业资产回报率(β=-0.021 6,P<0.05)和净资产收益率(β=-0.042 7,P<0.01)均具有显著负向影响。由此可见,在对被解释变量资产回报率和净资产收益率分别滞后一期处理后,所得结论依然成立,且解释变量家族成员出任总经理和家族后代成员参与管理的系数绝对值显著高于表 4和表 5中对应的解释变量系数,表明家族化管理不仅对家族企业当期绩效产生影响,还对家族企业财务绩效存在显著的滞后影响,也再次证明了上述假设检验结果稳健。

一. 描述性统计与相关性分析

二. 多元回归结果分析与讨论

三. 稳健性检验

-

作为国内民营企业的发展起源和重要组成部分,国内外学者对家族企业财务绩效等方面进行了诸多相关研究。本研究以家族企业为研究对象,以资源基础观和社会情感财富理论为基础,对家族化管理与家族企业财务绩效之间关系进行实证分析,得到结论:家族成员出任总经理对家族企业财务绩效具有显著的正向影响; 家族后代成员参与管理对家族企业财务绩效具有显著的负向影响; 市场化程度负向调节家族成员出任总经理与家族企业财务绩效之间的关系,正向调节家族后代参与管理与家族企业财务绩效之间的关系。根据研究结论,分别提出以下四方面对策建议:

第一,家族成员选择性让渡权利,强化公司治理制度。由于目前多数家族企业尚未完成代际更替,为确保家族基业长青,创始人应尽可能将自身的经验和丰富的社会资源向企业核心管理层进行选择性让渡,使现代公司治理制度优势得到更好的发挥,确保代际更替的顺利实现。

第二,加强对家族后代教育培训,树立正确的价值观。为降低家族后代成员参与的消极影响,家族创始人应更加注重对家族后代成员的培养和教育。为家族后代成员奠定丰富的学识和文化底蕴,树立正确的价值观; 为家族后代成员提供丰富的基层实践锻炼机会,向其传递创业和经营发展理念,有利于家族后代成员在参与家族企业管理时能够慎重做出正确的经营决策。

第三,加强对外部环境的认识,提高本地嵌入程度。企业家及其家族成员应了解环境对企业发展的深刻影响,加强对所在地区法律法规、文化和市场化制度的认识,根据外部环境匹配适当的企业管理方式,加深对所在地区的嵌入程度,更好地获取各种社会资源。

第四,优化政策环境,提高市场化程度。地方政府应该制定相应政策、引入丰富的外部资源,强化本地商业氛围,提高家族企业经营积极性,促使本地经济市场化水平不断提升,使具有现代化经营理念和公司治理模式的企业能够获得更好的发展。

本研究仍然存在不足之处有待未来的进一步研究:第一,没有考虑家族化管理与企业财务绩效关系之间是否存在中介变量的作用,未来研究可进一步探讨家族化管理对家族企业财务绩效的影响路径; 第二,对家族企业财务绩效的测量,仅通过财务指标资产回报率和净资产收益率进行考察,并未区分长短期绩效,未来研究可分别探讨家族化管理对企业长短期绩效是否具有不同影响; 第三,本研究仅考虑家族成员出任总经理与家族二代成员参与管理对家族企业财务绩效的影响,未来研究还可从家族成员教育背景等角度考察其对家族企业财务绩效的影响。

下载:

下载: