全文HTML

-

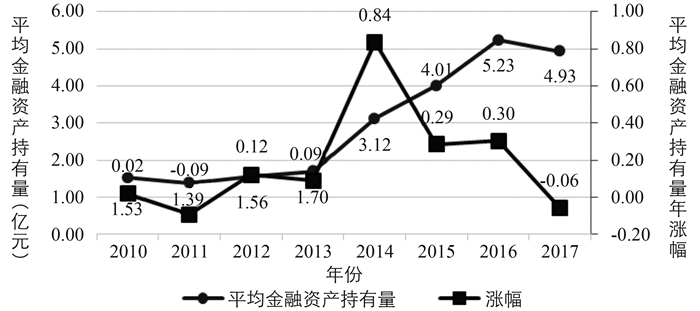

自20世纪80年代以来,无论是发达国家还是发展中国家都呈现出市场需求不断减小,实体经济产能过剩的局面,在资本市场不完善,风险和不确定性增加的情况下,相对于投资长期固定资产项目,企业更倾向于投资回报率高、可获得性高的短期金融资产[1],这就导致大量的资本流入金融、房地产等行业,以致虚拟经济快速发展,最终导致制造业“空心化”、实体企业“金融化”。从中国近年的发展来看,实体经济在国民经济中的占比日益降低,而虚拟经济占比却迅猛提升,金融业在国民经济中的占比于2015、2016年两年连续高达8.4%,该值不仅是我国10年前金融业占比的两倍,还远远超过了同期美国等发达金融体[2]。由图 1所示,自2010年起,中国非金融类(除金融、保险类和房地产行业外)上市公司持有的平均金融资产呈明显上升之势(除2011年和2017年稍有下降之势),由2010年的1.53亿增长到2017年的4.93亿,金融资产的平均持有量在短短几年之内增长了三倍之多。由此可见,我国金融化问题不容小觑,探讨和研究如何抑制企业金融化趋势、降低经济金融风险成为学术界和实务界的当务之急,为减小实体经济和虚拟经济回报的差距,积极响应国家发展实体经济的重大战略和政策导向而做出努力,具有一定的现实意义和重要性。

自20世纪90年代以来,我国先后掀起了三次下海经商热潮,尤其是在1992年邓小平南巡平息了私营经济姓“资”还是姓“社”的问题之后,下海潮更是达到了一个新的高度,一大批官员“弃政从商”,知识分子“弃文从商”,而这些“下海”的企业家中不乏曾在高校任职、从事科学研究的知识分子。如今,曾经或目前在高校任教、科研机构任职和协会从事研究的知识分子依旧活跃在商业的舞台上,据本文统计,观测样本中约有36%的企业聘请了具有学术背景的高管。管理者拥有企业的控制权,能够决定企业的行为和业绩。姜付秀等的研究表明,管理者不同的教育背景、工作经历、团队年龄等背景特征会有不同的企业行为选择[3]。已有的研究表明,不同工作经历的管理者也会做出不同选择,例如具有发明家经历的高管能显著提高企业创新[4],具有贫困经历的高管能促进企业的慈善捐赠[5];Wiersema,Bantel的研究表明年轻的管理者具有更强的适应力和创新精神而年龄越大的管理者越倾向于更加保守的企业战略[6];高管的学历水平能显著降低企业过度投资行为[3]。除此之外,管理者的性别也与企业投资行为息息相关,女性高管能显著抑制企业的过度投资,提升企业绩效[7]。周楷唐等基于“高层梯队理论”研究了高管学术经历与企业债务融资成本的关系,发现具有学术经历的高管能有效降低企业债务融资成本[8]。然而,已有的文献没有关注到高管的学术经历对企业金融化的影响。总而言之,企业的经营管理被深深打下了管理者背景特征的“烙印”,那么,具有学术背景的高管对企业的经营管理有何影响,给企业打下了怎样的“烙印”。现有的文献大多基于“高层梯队理论”研究了高管的性别、年龄、性格特征如过度自信、教育背景、学历背景和个人经历等背景特征对企业管理的影响[3, 5, 7, 9, 12]。鲜有文献研究高管学术背景对企业经营管理行为的影响,周楷唐等研究了高管学术经历对公司债务融资成本的影响[8],而根据本文统计数据发现有35.58%的样本聘用了具有学术背景的高管,这说明具有学术背景的高管在中国企业管理中发挥着不可忽视的作用,因此研究高管的学术背景对于理解我国企业管理和发展具有重要的意义。

“烙印理论”(Imprinting Theory)发源于生物学,该理论认为个体在成长过程中存在特定的“环境敏感”时期[10],个体会形成和这些“敏感”时期相对应的“烙印”,而且该“烙印”对个体的影响是长期且重大的[11],不会随后续外部环境的改变而改变。企业高管曾经或现在高校任职、科研机构任职和协会从事研究,经过长期的“学术训练”,给其留下的“学术印记”对其生活或者工作都会造成一定影响,当他们从事企业管理活动时自然也会留下与之相匹配的“学术烙印”。现有文献研究了董事会和管理层拥有学术成员的影响,研究表明董事会中拥有学术成员的公司具有更高的业绩敏感性和更高的盈利质量和股价信息[12],表现出较高的企业社会责任[13],不仅如此,具有学术背景的董事能够通过促进获取和吸收外部知识来增强企业的竞争优势[14],公司董事成员学术背景人数的多少还与研发投入和产品市场竞争存在正相关关系[15]。关于管理层方面,研究表明高管的学术资本能够促进企业创新[16],降低上市公司的审计费用[17]。但截至目前,没有研究高管学术背景对企业金融化的影响,而金融化正是当前企业频繁出现、亟待解决的现象。

本文基于烙印理论分析了具有学术背景的高管对企业金融化的影响,以我国沪深两市A股上市公司2010-2017年的数据为研究样本,对高管学术背景与企业金融化之间的关系进行了研究分析。实证发现,具有学术背景的高管能够显著降低企业持有的金融资产并且高管比例越高抑制效应越明显,这一结果在采用两阶段回归法(2SLS)、倾向得分匹配法(PSM)、更换被解释变量和解释变量的度量方法之后,结论依然成立。紧接着,我们对具有学术背景的高管对企业金融化的作用机制进行了分析,发现具有学术背景的高管更加注重企业的实体投资和创新投入而不是金融资产的配置,根据资源配置理论,金融资产的配置数量就会减少从而降低企业金融化程度。此外,本文还进一步分析了具有学术背景的高管在不同情境下对企业金融化的影响,研究结果表明,具有学术背景的高管无论是在较好的金融生态环境还是较差的环境中都能显著降低企业的金融化程度,不随外部环境而变化,在外部融资约束较低的时候,抑制企业金融化的效应更加显著。最后,本文还对企业金融资产的异质性进行了分析,将企业持有的金融资产划分为投机性金融资产与保值性金融资产,结果发现,具有学术背景的高管能够显著降低企业投机性金融资产的持有从而降低企业金融化程度。

本文的研究贡献主要体现在以下几个方面:(1)基于烙印理论,研究了具有学术背景的高管对企业金融化的影响,现有文献主要关注的是金融化对企业造成的影响,例如金融化对实业投资、企业创新、企业未来发展等方面的影响,而本文着眼于企业金融化的影响因素,从高管背景特征入手,研究了学术背景高管与企业金融化之间的关系,进一步丰富了关于金融化和公司高管团队特征研究的相关文献;(2)以往的文献着眼于高管的从军经历、贫困经历和财务经历等早期经历对企业经营管理的影响,是基于高层梯队理论的分析,本文则基于烙印理论,研究和分析了高管的学术经历对企业金融化的影响,拓展了关于企业管理领域的研究视野;(3)本文不仅研究了具有学术背景的高管与实体企业金融化的关系,还试图提供进一步证据,打开学术背景高管抑制实体企业金融化的“黑箱”,发现高管的学术经历使得他们更加审慎和保守,自律性更强,社会道德和社会责任的标准和意识都更高,创新性也更高,更加注重企业的创新活动,致力于发展企业的主营业务,根据资源配置理论,实体配置的数量越多金融资产的投资数量就会相应减少;(4)本文不仅从总体上分析了高管的学术背景对企业金融资产的影响,而且还考虑到了企业金融资产的异质性,将企业持有的金融资产划分为投机性金融资产与保值性金融资产,对比分析了高管的学术背景对两类金融资产的影响差异,从而延伸了高管特征对企业金融化的影响研究。

-

印记的基本思想可以追溯到早期生物学文献的概念,Marquis和Tilcsik将其定义为一个过程,他们认为焦点实体在某个短暂的敏感性时期会发展出与环境相匹配的特征,这些特征在随后时期会持续存在并且不会随外部环境变化而变化[11]。烙印理论(Imprinting Theory)的第一个特征是焦点实体在某个敏感时期更容易受环境影响,McEvily,Jaffee,Tortoriello将个体职业的早期阶段概化为相关敏感时期,印记的敏感时期发生在个体“关键的发展阶段”[21],高管早年从事学术研究的期间是他们的关键发展阶段同时也是他们人生历程中的敏感时期;第二个特征是焦点实体在敏感时期受到环境的影响更加重大,个体在敏感时期经历的焦虑和认知改变,会随环境刺激更加敏感,这时候他们就会形成新的认知、采用新的行为,他们的后续行为也会烙上与该敏感时期相匹配的印记,高管早年的学术经历使他们形成了学术思维,深深烙印于他们的思想和行为上;第三个特征就是就算环境发生了变化印记依然存在,McEvily等的研究表明,律师、经理和科学家虽然离开了早期学习阶段,但是在其后续生涯中还是会保持这个时期形成的认知和行为[21],从事过学术研究的个体也一样,尽管他们现在不从事学术研究,但他们在今后的生活和工作中也会保持学术时期形成的思维和行为。

烙印理论主要应用于创业研究领域[22],以往的文献也主要侧重于研究创业组织是如何被打上烙印的,比如用烙印作为“机会发现论”的基础来解释为何一部分人比另一部分人更容易识别或发现创业机会[23],企业创立时的条件和面临的环境特征会对企业后续发展产生持续的影响[24],然而却很少有学者关注企业家个体是如何被打上烙印的以及“烙印”产生的后续影响。戴维奇等基于“烙印理论”讨论了民营企业“不务正业”的动因,得出了民营企业家的“体制内”经历通过发展能力烙印和认知烙印促进了企业在成长过程中介入房地产等业务来“赚快钱”的结论[22];杜勇等基于烙印理论考察了CEO海外经历对企业盈余管理的影响,分析得出了CEO的海外经历对企业盈余管理具有显著的负向影响的结论[25],故本文尝试分析企业高管的学术背景会给企业带来怎样的影响。

在过去的研究中,绝大多数的文献主要关注的是金融化的原因和后果。在金融化的原因研究方面:从宏观层面来看,由于整体经济增长率的放缓,实体经济的停滞,金融资本主义日益依赖于增长扩大货币资本[26],资本积累过程变得金融化,侧重于金融的增长,利润越来越多地通过金融渠道而不是贸易和商品生产等实体经济产生[27];从企业层面来看,由于主业投资通常具有周期长、结果不可预测、失败风险大等特征,企业管理者和大股东出于降低私人成本的考虑,选择投资在金融资产方面,以期获得管理权和控制权[20, 28],企业管理层迫于股东的压力,为了控制劳动力成本,满足资本市场股息和股价升值的要求[29],得到更加快速的回报[18],而另一种观点认为金融资产的“蓄水池”效应会“反哺”企业,企业持有交易性金融资产和现金主要是出于“蓄水池”动机[30],在主业投资缺乏资金时,会将配置金融资产所获得的收益“反哺”主业,从而减弱主业投资对外部融资的依赖,降低财务困境成本[31]。

在金融化的后果研究方面:从宏观层面来看,经济活动的重心从生产转移到金融,金融投资正在取代实物投资,正逐渐成为实体经济的独裁者,资本并没有以一种基本的方式前进,而是陷入了一个似乎永无止境的停滞和金融爆炸的循环中[29]。金融化加剧了收入的不平等,导致收入分配两极化[32],增加了全球经济的脆弱性,不少学者都认为近年来的金融和经济危机都是由金融化引起的[27, 32];从企业层面来说,企业金融化抑制了企业投资[32],“挤出”了企业固定资产等实物资本投资[18],抑制了企业创新[19]。实体企业跨行业套利不但没有缓解企业投资活动面临的融资约束,反而使企业主业投资不断缩小,导致实体企业“空心化”,损害企业未来主营业绩[20]。

高管早年的学术训练培养了他们严谨的学术思维,使得他们在逻辑上更加审慎,在行为上更加自律和保守[12-13],他们更加相信自己的专业知识并且更加会根据专业知识来进行分析和判断。在经济“金融化”的大背景下,大多企业都争先恐后地将企业资产投入金融或房地产等行业以期获得超额利润,但是具有学术背景的高管并不会随波逐流盲目投资,他们会根据自己的专业知识来分析金融资产的利弊从而决定是否进行投资。不仅如此,他们的社会道德更高、社会责任意识也更强[13],这使得他们做事更加稳健,对企业更加负责,更加注重企业的未来发展,对于会损害企业未来主业业绩、降低实业投资率、导致经济发展不平衡[20, 29]的金融资产,他们并不会像其他企业的管理者一样对金融资产趋之若鹜,盲目持有。学术背景高管的稳健性、自律性、较高的社会道德等一系列特质使得他们会更加倾向于企业的实体投资,更加注重企业的长期发展,由于企业资源的有限性,金融投资与实体投资是一种替代关系[33],若企业更倾向于实体投资,金融资产投资必然会减少。

大学是一个“创新倾向”的组织,教师拥有获取各种信息的智力和能力,他们会一直努力获取世界前沿知识,紧紧跟随世界潮流[34]。Acs,Audretsch,Feldman等人的研究表明经济中重要领域的技术变革主要是基于学术研究[35],无论是在高校任教还是在科研机构任职或者协会从事研究的工作人员,他们的专业性都很高,有研究表明员工专业化程度高的组织创新性也更高[36],创新已然成为学术研究必不可少的活动,是学术研究者必备的一项技能,他们的工作需要创新,他们的生活也离不开创新,创新已经深深烙印在他们脑中。而现有的一系列研究表明企业金融化会抑制企业创新,实体企业金融化的套利动机会显著抑制技术创新的动力[19],金融资产配置也会显著降低企业当期研发创新等等,这些研究表明企业金融化会抑制企业创新,这与学术背景高管的“创新性”相悖,学术研究者的创新性使得他们更加倾向于企业的创新活动。根据资源配置理论,高管团队将企业有限的资源投入到创新活动上,那么其他方面的投资必然会减少,更何况金融资产会显著抑制企业创新。

综上所述,我们认为无论是因为学术背景高管的严谨性还是创新性这一系列特质,他们都不会热衷于投资金融资产,故提出本文主假设H0:高管的学术背景会显著抑制企业金融化。

-

本文选取2010-2017年中国沪深两市全部A股上市公司作为初始研究样本。我们按照以下原则对初始样本进行筛选:1.剔除ST、*ST类公司数据;2.考虑到金融、保险和房地产行业的特殊性,按照以往研究惯例,我们剔除了金融、保险和房地产行业上市公司的相关数据;3.剔除与本文相关数据缺失的样本;4.考虑到高管成员的金融背景对金融投资的影响,我们剔除了具有金融背景的高管团队数据。最终,本文获取了18 911个公司-年度观测值,本文所使用的财务数据均来自CSMAR(国泰安)数据库,为了避免极端值对分析结果造成的影响,我们对所有连续变量进行了上下1%的winsorize缩尾处理。

-

金融化程度(Fin)指标。本文以企业持有的金融资产占总资产的比例来表示企业的金融化程度,即金融化程度(Fin)=企业持有的金融资产/总资产,依据杜勇等对金融资产的定义,将交易性金融资产、衍生金融资产、发放贷款及垫款净额、可供出售金融资产净额、持有至到期投资净额、投资性房地产净额纳入金融资产的范畴[20]。

-

学术高管(xsgg)。本文将学术高管定义为:(1)学术高管比例(r_xsgg),(2)是否具有学术经历的高管(isxsgg)。(1)学术高管比例为高管团队中具有学术背景的高管人数占高管总人数的比例,即学术高管比例(r_xsgg)=具有学术经历的高管人数/高管团队总人数。其中,高管团队指董事会及董事会成员之外的直接参与企业经营决策的高级管理人员,包括企业的总经理、总裁、CEO、副总经理、副总裁、董秘和年报上公布的其他管理人员(包括董事中兼任的高管人员),学术高管是指过去或现在具有在高校任教、科研机构任职或在协会从事研究的学术经历的高管。(2)是否具有学术经历的高管(isxsgg)是高管学术经历的虚拟变量,将企业高管团队成员内具有学术背景的高管时赋值为1,否则为0。

-

根据已有文献,本文纳入了公司财务特征以及治理等相关方面的控制变量,具体包括经营净现金流(CFO)、公司规模(lnsize)、公司资本结构(Lev)、经营净利润率(Roa)、主营业务收入增长率(Growth)、企业年龄(lnage)、股权集中度(Shrcr5)、企业投资规模(lnvest)和年度与行业虚拟变量,变量的详细定义见表 1。

-

为了检验高管学术背景对企业金融化的影响,借鉴已有文献,本文建立了如下实证模型:

在上述模型中,Fin为被解释变量,表示企业金融化程度,以企业持有的金融资产占总资产的比例来表示。xsgg为解释变量,分别取连续变量(1)学术高管比例(r_xsgg)和虚拟变量(2)是否具有学术经历的高管(isxsgg)来考察学术背景高管与企业金融化之间的关系。若H0成立,预计xsgg的系数∂1显著为负,即表明了企业具有学术背景的高管抑制了企业金融化。Controls为控制变量,ε为随机误差项。

一. 样本选取及数据来源

二. 变量界定

1. 被解释变量

2. 解释变量

3. 其他控制变量

三. 实证模型

-

表 2报告了变量的描述性统计。由表 2的描述性统计结果可知,在本文的样本中,金融化程度(Fin)的均值为0.011 8,说明有1.18%(约223个公司-年度观测值)的样本观测值持有金融资产,而Fin的最大值达到了0.248,该值表明部分公司持有金融资产的比例达到了公司总资产的24.8%。学术高管比例(r_xsgg)的均值为0.077,说明观测样本中学术高管人数占总高管人数的比例为7.7%,最大值为0.571,该值说明一些公司的高管团队中具有学术背景的高管人数达到了57.1%,超过了高管团队成员的一半。是否具有学术经历的高管(isxsgg)的均值为0.355 8,说明有35.58%的观测样本聘用了具有学术背景的高管,而该值的最大值高达1,说明一些公司偏好聘用具有学术背景的高管,其余控制变量的描述性统计结果如表 1所示,不再一一赘述。

表 3报告了本文变量的相关性分析。由表 3的相关性分析结果可知,金融化程度(Fin)与学术高管比例(r_xsgg)的相关系数为-0.046,在1%的水平上显著,初步表明具有学术背景的高管人数占高管团队总人数的比例越高,高管学术背景抑制企业金融化的效应越明显。金融化程度(Fin)与是否具有学术经历的高管(isxsgg)的相关系数为-0.058,在1%的水平上显著,初步表明相较于没有学术背景的高管团队,高管团队中拥有学术背景高管的企业金融化程度更低,初步证实了本文的研究假设H0,但还需通过更加严格的控制其他因素的多元回归分析来检验。

-

表 4报告了高管学术背景对企业金融化影响的回归结果。第(1)列和第(3)列报告了没有加入控制变量和没有控制行业、年度固定效应的回归结果,第(2)列和第(4)列报告了加入控制变量和控制行业、年度固定效应的回归结果。第(1)列和第(2)列的解释变量都是学术高管比例(r_xsgg),第(1)列r_xsgg的估计系数为-0.014 4,且在1%的水平上显著;在加入了控制变量,控制了年度、行业效应之后,第(2)列r_xsgg的估计系数为-0.008 5,在1%的水平上显著,表明高管学术背景能降低企业金融化0.85个百分点,从经济意义上看,在以r_xsgg为被解释变量时,样本高管团队中具有学术背景的高管人数每增加1%,企业金融化程度降低11.04%(0.008 5/0.077 0),有效抑制了企业金融化。第(3)列和第(4)列的解释变量皆为是否具有学术经历的高管(isxsgg),第(3)列isxsgg的估计系数为-0.004 8,在1%的水平上显著;在加入了控制变量,控制了年度、行业效应之后,第(4)列isxsgg的估计系数为-0.003 3,在1%的水平上显著,表明高管团队拥有学术背景的企业能降低企业金融化0.33个百分点,从经济意义上看,在以isxsgg为被解释变量时,相比于没有学术背景高管的企业,高管团队中具有学术背景高管的企业金融化程度要低0.003 3,这就意味着高管学术背景对企业金融化的降低效应是样本均值的0.93%(0.003 3/0.355 8)。无论解释变量是连续变量学术高管比例(r_xsgg)还是虚拟变量是否具有学术经历的高管(isxsgg),经济意义都十分显著。综上所述,本文提出的假设H0得到验证。

-

1.为了解决学术背景高管与企业金融化的因果关系,本文采用工具变量法进行两阶段回归(2SLS),选用同一年度同行业其他公司拥有学术背景高管的比例作为工具变量,结果表明不存在上述问题。2.为了控制本文变量的选择性偏误,我们根据企业是否具有学术经历的高管,采用倾向得分匹配方法(PSM)来进行处理。3.为了保证本文结果的有效性和科学性,我们更换被解释变量的度量方法,采用企业持有金融资产的绝对规模来衡量企业的金融化程度,用ln(金融资产+1)来度量企业的金融化程度(Fin)[30]。4.由于CEO是企业经营决策的主要制定者,是企业中最有影响力的决策者[25]。为了进一步检验本文结论的稳健性,我们将CEO作为学术高管比例(r_xsgg)的替代变量,考察具有学术背景的CEO是否能有效抑制企业金融化。

一. 描述性统计和相关性分析

二. 多元回归分析

三. 稳健性测试

-

前文已经发现了高管学术背景能够有效抑制企业的金融化趋势,但并未说明为什么高管学术背景能够有效抑制企业的金融化趋势,本部分重点分析学术背景高管抑制企业金融化的作用机制,即高管学术背景为什么会影响企业金融化。在此,我们试图提供进一步证据,打开高管学术背景抑制企业金融化的“黑箱”。

-

高管早期职业生涯从事学术研究培养了他们严谨的学术思维和审慎的逻辑思维,拥有较高的社会道德和社会责任意识[12-13]。他们更加倾向于利用自己的专业知识审时度势、权衡利弊、经过深思熟虑后才作出决定,并不会仅仅因为看到金融资产投资回报率高、可获得性高和周期性短这些单方面的优点就会盲目持有,他们也会考虑到金融资产对实体经济造成的损害,他们会全面考虑金融资产的利弊。不仅如此,他们更高的社会道德和社会责任意识使得他们更加注重企业的长期发展,对企业更加负责,经营企业时也会更加稳健,会将重心放在企业的主营业务发展上。由于企业资源的有限性,金融投资与实体投资实际上是一种替代关系[33],若企业高管更倾向于实体投资,那么对金融资产的投资必然会减少。为了检验学术背景高管更加注重实体资本投资而不是配置金融资产,本文建立(1)(2)(3)中介效应模型来检验该路径。

在(1)(2)(3)中,Fin表示企业金融化程度,r_xsgg表示学术高管比例,r_sttz表示企业实体资本投资,将r_sttz定义为企业购建固定资产、无形资产和其他长期资产支付的现金与企业总资产之比,其余变量与上文定义一致。表 5报告了路径“高管学术背景-实物资本投资-企业金融化”的检验结果,报告结果如表 5所示,列(1)为不纳入中介因子的检验结果,Fin的回归系数显著为负,列(2)(3)为纳入中介因子的检验结果,学术高管比例(r_xsgg)与实体投资(r_sttz)的相关系数为0.009 4,显著为正且在1%的水平上显著,而实体投资(r_sttz)与金融化程度(Fin)的相关系数为0.049 9,显著为负且-0.049 9<-0.008 0,由此表明,实体投资是高管学术背景影响企业金融化的部分中介因子,通过Sobel检验,Z统计量也均通过了1%水平的统计检验,结果表明中介效应占总效应的5.52%,也进一步证明了具有学术背景的高管更加注重企业的实体投资而不是持有金融资产以获取超额利润。

-

Ross的研究表明大学是“创新倾向”的组织,从事教学和研究的大学教师紧紧跟随世界潮流,努力获取新知识[34],无论是高校还是在科研机构或者协会都属于专业性很强的组织,员工专业化程度越高的组织创新性也更高[36],研究表明经济中重要领域的技术变革主要源于学术研究[35]。这一系列研究都表明创新在学术研究领域有着不可撼动的地位,创新成为学术研究者的基本素质之一,也成为他们的一种习惯,深深烙印在他们身上,影响着他们的工作和生活。而现有文献大都表明企业金融化会显著抑制企业创新,因此基于此他们并不会热衷于持有金融资产,而会更加热衷于企业的创新活动。根据资源配置理论,若高管团队将企业有限的资源投入到创新活动上,那么对金融资产的投资也必然会减少。为了检验学术背景高管更加注重企业创新而不是配置金融资产,我们构建了模型(4)(5)(6)来检验“高管学术背景-企业创新活动-企业金融化”这一路径是否正确:

在(4)(5)(6)中,Fin表示企业金融化程度,r_xsgg表示学术高管比例,r_yftr表示企业研发投入,用企业研发投入与总资产之比(r_yftr)来衡量企业创新,其余变量与上文定义一致。报告结果如表 6所示,列(4)为不纳入中介因子的检验结果,Fin的回归系数显著为负,列(5)、(6)为纳入中介因子的检验结果,学术高管比例(r_xsgg)与研发投入(r_yftr)的相关系数为0.012 4,显著为正且在1%的水平上显著,而研发投入(r_yftr)与金融化程度(Fin)的相关系数为0.137 1,显著为负且-0.137 1<-0.006 8,由此表明,研发投入即创新投入是高管学术背景影响企业金融化的部分中介因子。Sobel检验的Z统计量通过了1%水平的统计检验,中介效应占总效应的19.94%,也进一步证明了具有学术背景的高管更加注重企业的创新活动而不是投资金融资产。

一. 具有学术背景的高管更注重实体资本投资

二. 具有学术背景的高管更加注重企业的创新

-

考虑到金融生态环境作为一种外部治理机制会对企业金融化产生影响,采用《中国地区金融生态环境评价》课题组对政府治理、经济基础、金融发展和制度与诚信文化四个方面对中国各地区评价的综合指数来衡量地区金融生态环境,若地区的综合评分大于0.5则赋值为1,表示该地区金融生态环境较好,反之,若综合评分小于0.5则赋值为0,表示该地区金融生态环境较差。周楷唐等的研究表明高管学术经历作为一种内在的自我约束机制,在外部监督机制较弱的时候能作为外部机制的替代[8],因此本文推测,更加自律的学术背景高管无论是在较好的金融生态环境还是较差的环境中都能显著降低企业的金融化程度,不随外部环境而变化。报告结果如表 7所示,在较好金融生态环境和较差金融生态环境下,高管学术比例(r_xsgg)与金融化程度(Fin)的相关系数为-0.010 0、-0.008 9,分别在1%和5%的水平上显著。这也与我们的预期是一致的,更加自律的学术背景高管无论是在较好的金融生态环境还是较差的环境中都能发挥抑制企业金融化的作用,并不会随外部环境的变化而变化。

此外,我们还考虑了在外部融资约束不同的情况下,高管学术背景对企业金融化的影响。因为SA指数的相对外生性和客观性,能较好地度量企业面临的融资约束,而且目前它的认可度也较高,故采用SA指数来衡量企业面临的融资约束,取SA=-0.737*Size+0.043*Size2-0.04*age,其中Size=ln(资产总计/1 000 000),age表示企业成立年限,因SA值为负数,故取绝对值,绝对值越大表示企业面临的外部融资约束越严重。我们按照SA值中位数的高低分为高融资约束和低融资约束两组,报告结果如表 7所示,在高融资约束组,回归系数为-0.005 8且不显著,在低融资约束组,系数为-0.007 7,且在1%的水平上显著,这说明高管学术背景在外部融资约束较低时能显著抑制企业金融化。在外部融资约束较低的时候,企业可以获取和支配的闲余资金较多,企业管理者可以用闲余的资金进行投资,而在这种情况下,高管学术背景对企业金融化的抑制效应依然明显,说明在外部融资约束较低的情况下具有学术背景的高管依然不会热衷于投资金融资产。

-

本文借鉴彭俞超等的做法,将交易性金融资产和可供出售金融资产归属为投机性金融资产[37],将衍生金融资产、发放贷款及垫款净额、持有至到期投资和投资性房地产划分为保值性金融资产,再对投机性金融资产和保值性金融资产进行回归,回归结果如表 8所示,第(1)列投机性金融资产的回归系数为0.012 7,显著为负且在1%的水平上显著,而第(2)列保值性金融资产的回归系数为0.000 5,虽然系数为负但是不显著。表 8的研究结果表明具有学术背景的高管厌恶投机性金融资产,主要是通过抑制企业持有的投机性金融资产来抑制企业金融化,第(2)列的回归结果虽然不显著,但是系数为负,表明具有学术背景的高管也不热衷于投资保值性金融资产。从总体上来看,无论是投机性金融资产还是保值性金融资产,具有学术背景的高管皆无持有意愿。

一. 截面分析

二. 金融资产异质性

-

着眼于我国实体经济脱实向虚和企业金融化的现实背景,从高管个人背景特征出发,结合烙印理论,分析了高管学术背景与企业金融化之间的关系。研究表明,具有学术背景的高管能有效抑制实体企业金融化,学术背景高管比例与企业金融化程度成反比,即具有学术背景高管的比例越高企业金融化程度越低,经过两阶段最小二乘法(2SLS)、倾向得分匹配方法(PSM)、更换被解释变量和更换解释变量这一系列的稳健性测试后上述结论依然成立。本文还分析了高管学术背景能降低企业金融化的机制,由于高管早期职业生涯的学术经历培养了他们的严谨性、创新性和更高的社会道德水平等一系列学术思维和学术行为,这使他们更加注重企业的实体资本投资和创新活动。本文还进一步分析了金融生态环境和融资约束外部环境对高管学术背景抑制企业金融化的影响,结果表明具有学术背景的高管无论是在较好的金融生态环境还是较差的环境中都能显著抑制企业金融化,在外部融资约束较低的时候能显著抑制企业金融资产的持有,区分了企业金融资产的投机性和保值性后发现,具有学术背景的高管主要通过降低企业的投机性金融资产来抑制企业的金融化程度。

-

本文基于烙印理论,从管理层的背景特征出发,探讨了企业高管团队拥有具有学术背景的高管对企业持有的金融资产的影响,首次研究了高管学术背景与企业金融化的关系,研究发现具有学术背景的高管能有效抑制实体企业金融化,这对于深入理解企业金融化和企业管理团队建设有一定的指导意义,企业应根据企业自身需要和宏观环境,重视管理者的个人经历,为其挑选合适的高管人员,为企业谋求更好的发展;随着学术背景高管人数占高管团队人数比例的增高,高管学术背景抑制企业金融化的效应越明显,故企业可以在一定程度内聘请较多的具有学术背景的高管。目前,我国资本“脱实向虚”问题严重,金融风险不断增大,而本文研究表明具有学术背景的管理者在一定程度上能有效抑制实体企业金融化,有利于实体经济的发展,这为上市公司的人才选拔和人力资源管理有一定的启示意义,同时也为政府部门制定相关政策激励具有学术背景的人才参与企业管理提供了微观证据支持。

下载:

下载: